The Early Turnover Scheme (ETS) gives you benefits when you replace your older diesel goods vehicles and buses with more environmentally friendly models.

At a Glance

Understanding the Early Turnover Scheme (ETS) |

With the Early Turnover Scheme (ETS), you enjoy discounted Prevailing Quota Premium (PQP) for your Certificate of Entitlement (COE) when you replace your existing vehicle with a more environmentally friendly model.

Your existing and replacement vehicles must meet the eligibility criteria to qualify for the ETS. |

Replacing your vehicle under the ETS |

To replace your vehicle, deregister the existing vehicle, then register your replacement vehicle within a month.

When you register your replacement vehicle, you will enjoy a discounted PQP for your COE.

Refer to the sample calculations for examples on how to calculate your PQP and COE values. |

Related digital services |

Enquire Discounted PQP Payable for Early Turnover Scheme |

Understanding the Early Turnover Scheme

The Early Turnover Scheme (ETS) encourages you to replace your older diesel goods vehicles and buses with cleaner, more environmentally friendly models. Instead of bidding for a new COE, you will enjoy a discounted Prevailing Quota Premium (PQP) for your replacement vehicle. Any COE rebate from your older vehicle will be transferred to the COE value of your replacement vehicle.

From 1 April 2021, the ETS has been enhanced and extended to include existing Euro IV Category C diesel vehicles. The Enhanced ETS has also replaced the current ETS.

Enhanced Early Turnover Scheme (ETS) (1 April 2021 to 31 March 2023)

The Enhanced ETS and Commercial Vehicle Emissions Scheme (CVES) are in effect from 1 April 2021 to 31 March 2023.

You can click here to find out more about CVES. Select your vehicle types (Goods Vehicle or Bus) and scroll down to the sections “Emission Incentive or Surcharge” and “Commercial Vehicle Emissions Scheme (CVES) for Light Goods Vehicles Registered From 1 April 2021 to 31 March 2023”.

Under the Enhanced ETS, existing Euro II, III and IV Category C diesel vehicles are eligible for the ETS incentive. The incentives will be based on the type of the existing vehicle and replacement vehicle registered under the Enhanced ETS.

Eligibility criteria and details for Enhanced ETS

To enjoy the benefits of the Enhanced ETS, your existing and replacement vehicles must meet the following criteria:

Your existing vehicle must be:

- a Category C vehicle

- not COE-exempted

- propelled by diesel, diesel-Compressed Natural Gas (CNG) or diesel-electric engines

- under the permanent ownership of the registered owner

- registered between 1 January 2001 and 31 December 2013, and deregistered between 1 April 2021 and 31 March 2023

- properly disposed of (i.e. scrapped or exported) before the replacement vehicle is registered, and COE rebate, if any, is successfully granted.

- have at least 1 day of unused COE or at least 1 day of its 20-year lifespan remaining when it is deregistered.

Your replacement vehicle must be:

- a Category C vehicle

- not COE-exempted

- a vehicle that meets Euro VI or equivalent emission standards

- classified as Band A or Band B, if it is covered by the CVES (if the replacement vehicle is classified as Band C, it is not eligible to be registered under the Enhanced ETS)

- registered under the same owner as the existing vehicle

- registered within 1 month of the deregistration date of the existing vehicle

- For example, if the existing vehicle is deregistered on 15 August 2021, the replacement vehicle must be registered by 14 September 2021.

- As the scheme ends on 31 March 2023, to be eligible for the Enhanced ETS, the last day to deregister is 31 March 2023 and its replacement vehicle must be registered by 30 April 2023.

Replacing your vehicle under the Enhanced ETS

Deregister your existing vehicle

If your existing or replacement vehicles are eligible for the Enhanced ETS, you can proceed to deregister your existing vehicle to enjoy the benefits of the scheme. You must then register a replacement vehicle within a month of deregistering your existing vehicle. See an example below:

If your existing vehicle is deregistered on: |

15 August 2021 |

Then your replacement vehicle must be registered by: |

14 September 2021 |

| As the scheme ends on 31 March 2023, to be eligible for the Enhanced ETS, the last day to deregister your existing vehicle is 31 March 2023 and its replacement vehicle must be registered by 30 April 2023. | |

Calculate your Prevailing Quota Premium (PQP)

Under the Enhanced ETS, you will enjoy a discounted PQP for your COE when you register your replacement vehicle.

You can click on the link below to check the discounted PQP payable for your COE.

The discounted PQP that you enjoy depends on:

- The unused COE period of the existing vehicle when it is deregistered

- The remaining 20-year lifespan of the existing vehicle when it is deregistered.

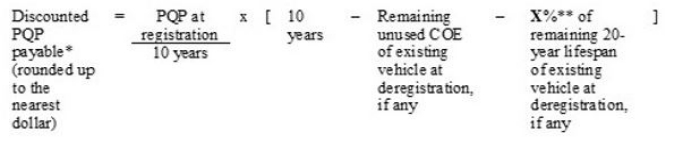

Your discounted PQP is calculated as follows:

* The discounted PQP you pay must be at least 10% of the PQP in the month you are registering the replacement vehicle.

** Refer to Table A below for the respective bonus COE period:

Table A

Existing Vehicle and Emission Standard |

Replacement Vehicle (Euro VI or equivalent) |

Bonus COE period |

|

Light Goods Vehicle (LGV) |

Euro II/III |

Band C under CVES[4] |

N/A |

Band A or B under CVES |

45%[2] |

||

Euro IV |

Band C under CVES[4] |

N/A |

|

Band A or B under CVES |

20%[2] |

||

Heavy Goods Vehicle (HGV) |

Euro II/III |

Vehicle with tailpipe emissions[1] |

80%[3] |

Vehicle without tailpipe emissions[1] |

100% |

||

Euro IV |

Vehicle with tailpipe emissions[1] |

40%[3] |

|

Vehicle without tailpipe emissions[1] |

80% |

||

[1] Tailpipe emissions refer to air pollutants hydrocarbons, carbon monoxide, nitrogen oxides and particulate matter

[2] The same incentive applies if replacement vehicle is an HGV

[3] The same incentive applies if replacement vehicle is a Band A or B LGV under the CVES

[4] If the replacement vehicle is classified as Band C under CVES, it is not eligible to be registered under the Enhanced ETS

When calculating the discounted PQP, the sum of the unused COE period and the proportion of the remaining 20-year statutory lifespan is capped at 10 years. Any excess bonus COE period from the existing vehicle will be forfeited.

If you have already used, encashed or transferred the COE rebate from the deregistered vehicle before registering your replacement vehicle, you will need to return the rebate amount to LTA when you register your replacement vehicle for the Enhanced ETS.

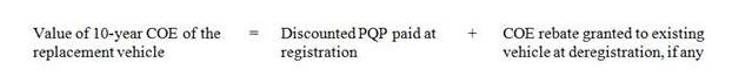

Calculating the 10-year COE value of your replacement vehicle

Once you have registered your replacement vehicle, the value of its 10-year COE will be calculated as follows:

You can check the value of your 10-year COE via our digital service by clicking on the button below:

Sample calculations for vehicles deregistered between 1 April 2021 and 31 March 2023

Example 1

- Category C existing vehicle with MLW = 3,000kg (i.e. LGV)

- Propelled by diesel, diesel-CNG or diesel-electric

- First Registration Date (FRD) is between 1 January 2001 and 30 September 2006, or meets Euro II or equivalent emission standards

- Deregistered between 1 April 2021 and 31 March 2023

- Has both unused COE and remaining 20-year lifespan at deregistration

Let’s assume:

| Existing Vehicle | Replacement Vehicle |

| Quota Premium paid = $8,000 FRD: 1 September 2004 10-year Cat C COE Expiry Date: 31 August 2024 Reaches 20 years old on: 31 August 2024 Deregistration Date: 31 August 2021 |

Meets Euro VI or equivalent emission standards

Classified as a Band A or B LGV or HGV Prevailing Quota Premium for Cat C COE: $30,000 Registration Date: 1 September 2021 |

Existing vehicle at deregistration:

Remaining unused COE period = 1 September 2021 to 31 August 2024 = 3 years

Remaining 20-year lifespan = 1 September 2021 to 31 August 2024 = 3 years

Bonus COE period: 45%

Discounted PQP payable for replacement vehicle at registration:

= $30,000/10 x [10 – 3 – (45% x 3)] OR $30,000 x 10%; whichever is higher

= $3,000 x [10 – 3 – 1.35] OR $30,000 x 10%; whichever is higher

= $3,000 x 5.65 OR $30,000 x 10%; whichever is higher

= $16,950 OR $30,000 x 10%; whichever is higher

= $16,950

Value of the 10-year COE of the replacement vehicle after registration:

= Discounted PQP paid at registration of replacement vehicle + COE rebate of existing vehicle at deregistration

= $16,950 + (3/10) x $8,000

= $16,950 + $2,400

= $19,350

Under the CVES for registering a Band A or B LGV, the vehicle owner would also qualify for a CVES incentive of $30,000 for Band A or $10,000 for Band B.

Example 2

- Category C existing vehicle with MLW = 5,000kg (i.e. HGV)

- Propelled by diesel, diesel-CNG or diesel-electric

- First Registration Date (FRD) is between 1 October 2006 and 31 December 2013, or meets Euro IV or equivalent emission standards

- Deregistered between 1 April 2021 and 31 March 2023

- Has both unused COE and remaining 20-year lifespan at deregistration

Let’s assume:

| Existing Vehicle | Replacement Vehicle |

| Quota Premium paid = $13,000 FRD: 1 September 2008 10-year Cat C COE Expiry Date: 31 August 2028 Reaches 20 years old on: 31 August 2028 Deregistration Date: 31 August 2022 |

Meets Euro VI or equivalent emission standards

Classified as a Band A or B LGV or HGV with tailpipe emissions Prevailing Quota Premium for Cat C COE: $30,000 Registration Date: 1 September 2022 |

Existing vehicle at deregistration:

Remaining unused COE period = 1 September 2022 to 31 August 2028 = 6 years

Remaining 20-year lifespan = 1 September 2022 to 31 August 2028 = 6 years

Bonus COE period: 40%

Discounted PQP payable for replacement vehicle at registration:

= $30,000/10 x [10 – 6 – (40% x 6)] OR $30,000 x 10%; whichever is higher

= $3,000 x [10 – 6 – 2.4] OR $30,000 x 10%; whichever is higher

= $3,000 x 1.6 OR $30,000 x 10%; whichever is higher

= $4,800 OR $30,000 x 10%; whichever is higher

= $4,800

Value of the 10-year COE of the replacement vehicle after registration:

= Discounted PQP paid at registration of replacement vehicle + COE rebate of existing vehicle at deregistration

= $4,800 + (6/10) x $13,000

= $4,800 + $7,800

= $12,600

Under the CVES for registering a Band A or B LGV, the vehicle owner would also qualify for a CVES incentive of $30,000 for Band A or $10,000 for Band B. There is no CVES incentive for registering an HGV.

Example 3

- Category C existing vehicle with MLW = 5,000kg (i.e. HGV)

- Propelled by diesel, diesel-CNG or diesel-electric

- First Registration Date (FRD) is between 1 October 2006 and 31 December 2013, or meets Euro IV or equivalent emission standards

- Deregistered between 1 April 2021 and 31 March 2023

- Has both unused COE and remaining 20-year lifespan at deregistration

Let’s assume:

| Existing Vehicle | Replacement Vehicle |

| Quota Premium paid = $13,000 FRD: 1 September 2008 10-year Cat C COE Expiry Date: 31 August 2028 Reaches 20 years old on: 31 August 2028 Deregistration Date: 31 August 2022 |

Meets Euro VI or equivalent emission standards

Classified as an HGV without tailpipe emissions Prevailing Quota Premium for Cat C COE: $30,000 Registration Date: 1 September 2022 |

Existing vehicle at deregistration:

Remaining unused COE period = 1 September 2022 to 31 August 2028 = 6 years

Remaining 20-year lifespan = 1 September 2022 to 31 August 2028 = 6 years

Bonus COE period: 80%

Discounted PQP payable for replacement vehicle at registration:

= $30,000/10 x [10 – 6 – (80% x 6)] OR $30,000 x 10%; whichever is higher

= $3,000 x [10 – 6 – 4.8] OR $30,000 x 10%; whichever is higher

= $3,000 x 0 OR $30,000 x 10%; whichever is higher

= $30,000 x 10%

= $3,000

Value of the 10-year COE of the replacement vehicle after registration:

= Discounted PQP paid at registration of replacement vehicle + COE rebate of existing vehicle at deregistration

= $3,000 + (6/10) x $13,000

= $3,000 + $7,800

= $10,800

There is no CVES incentive for registering an HGV.